The structure of this post is to first provide for each stock the description + statistics + Superinvestors who own it as a top 10 position.

Then for the stocks you are interested in, there is a link at the end of each section that takes you to the associated footnote with much more information on the company (from investor presentations and the latest earnings).

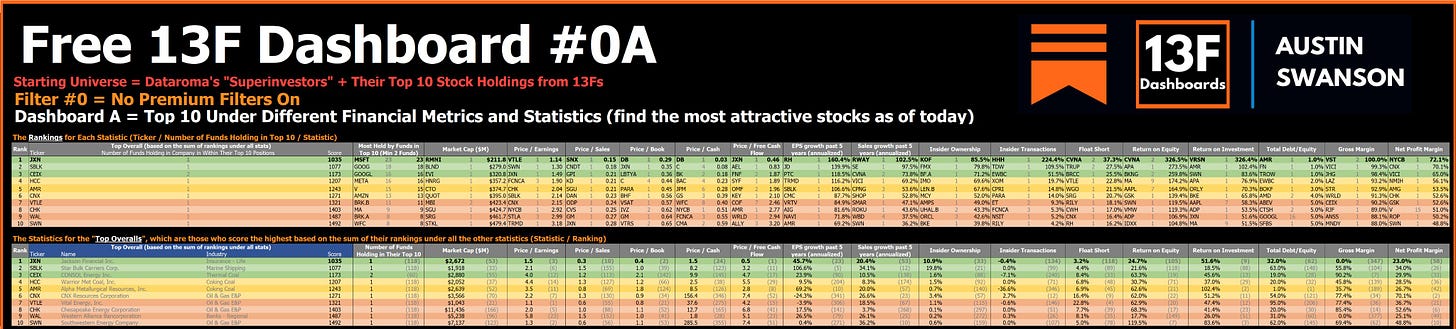

The purpose of this is to provide new stock ideas / help generate new ideas, from the subset of “Superinvestors” + their top 10 holdings, and from that universe of 383 stocks as of Update 6, the following are the top 10 stocks overall on a statistical basis.

Top 10 Stocks in Update #6

Of the top 10 holdings within the 13Fs of Superinvestors (~383 stocks), the following are the top 10 overall stocks as of 8/18 (in Update #6) on a statistical basis:

Jackson Financial Inc. (JXN)

Star Bulk Carriers Corp. (SBLK)

CONSOL Energy Inc. (CEIX)

Warrior Met Coal, Inc. (HCC)

Alpha Metallurgical Resources, Inc. (AMR)

CNX Resources Corporation (CNX)

Vital Energy, Inc. (VTLE)

Chesapeake Energy Corporation (CHK)

Western Alliance Bancorporation (WAL)

Southwestern Energy Company (SWN)

(The overall ranking / "score" for a given stock is based on each ranking across many different statistics, such as P/E, P/FCF, EPS and sales growth, debt/equity, ROE, margins, insider purchases & ownership, and much more)

All of these top 10 stocks have a:

Market Cap < $12B (most under $4B)

P/E < 5.8

P/S < 1.5

P/B < 2.1

P/FCF < 7.4

Positive sales growth over last 5 years

ROE > 17.7%

ROI > 18.5%

D/E < 95%

Net Profit Margin > 23%

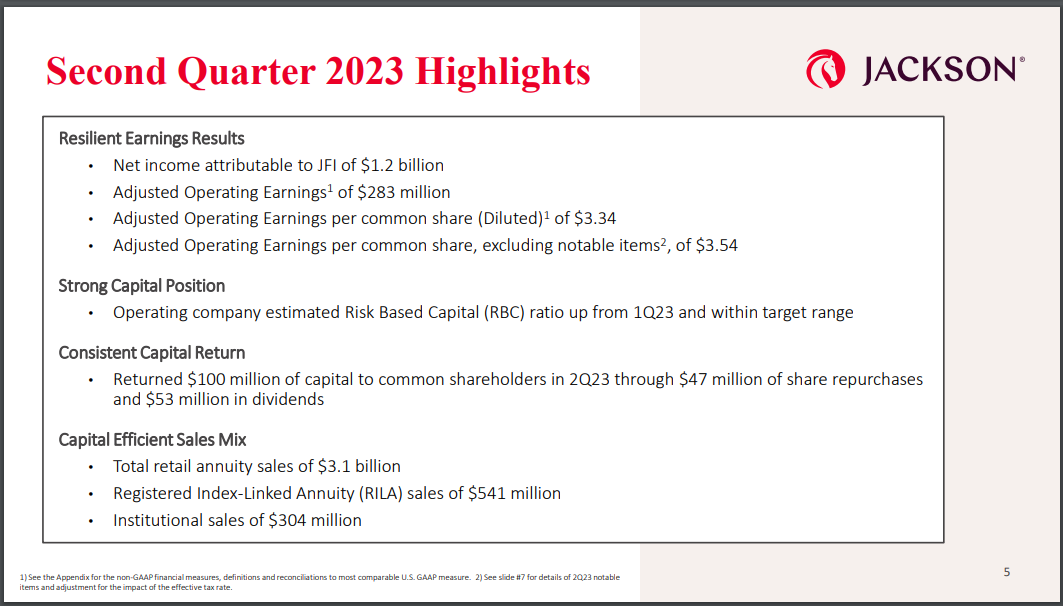

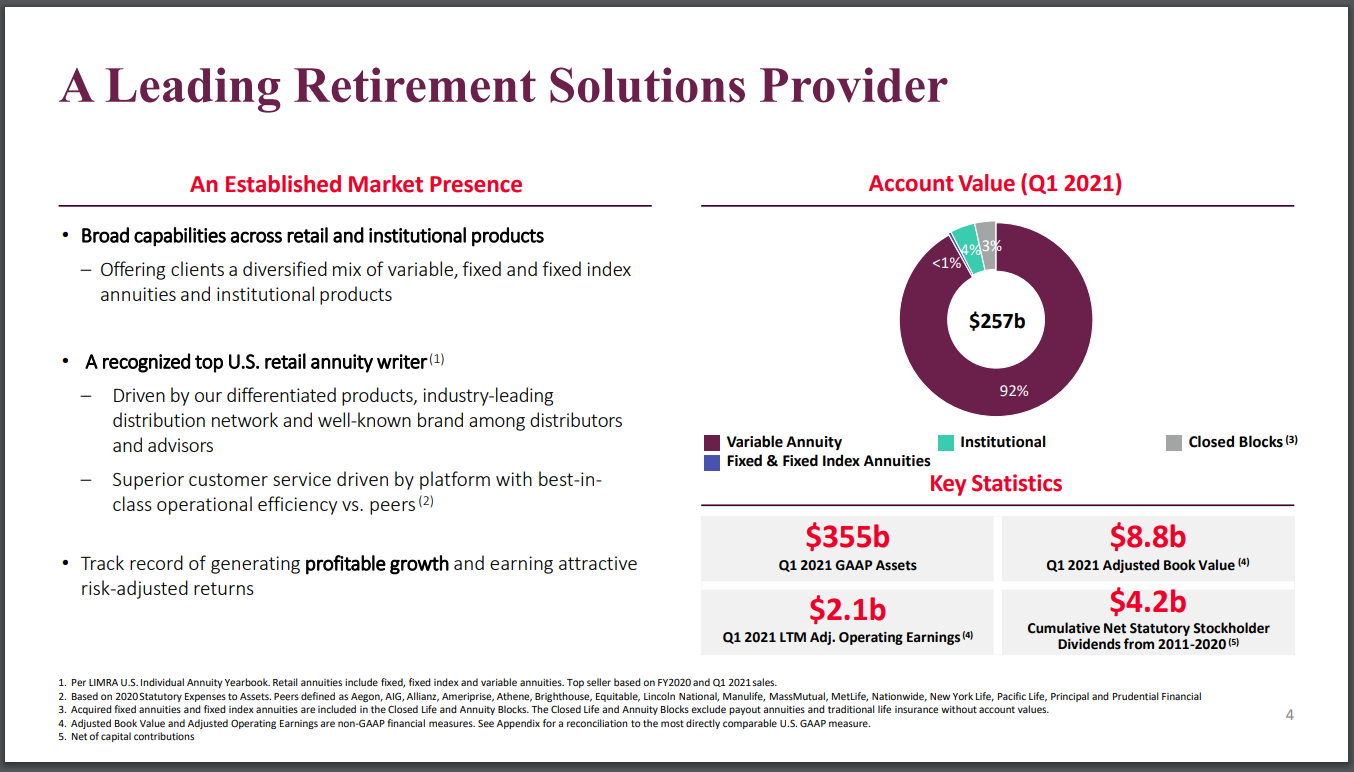

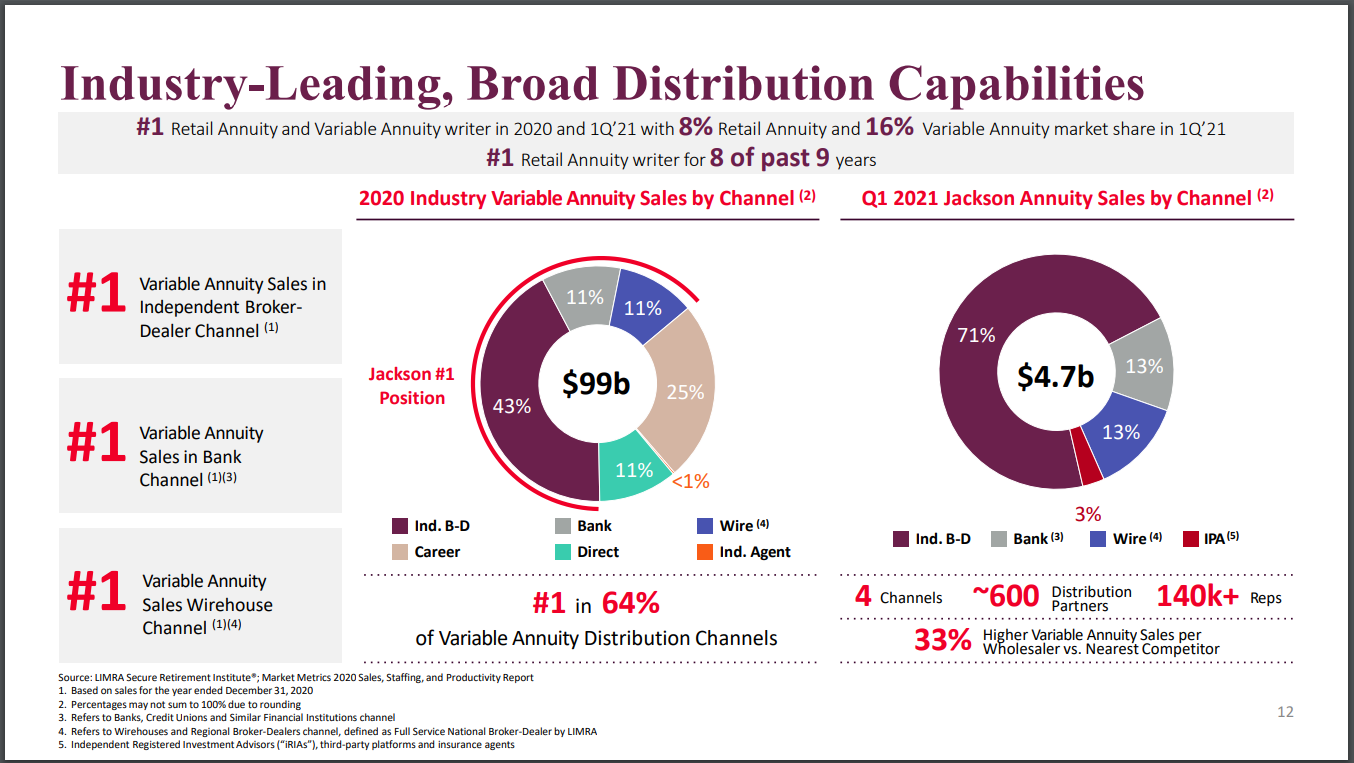

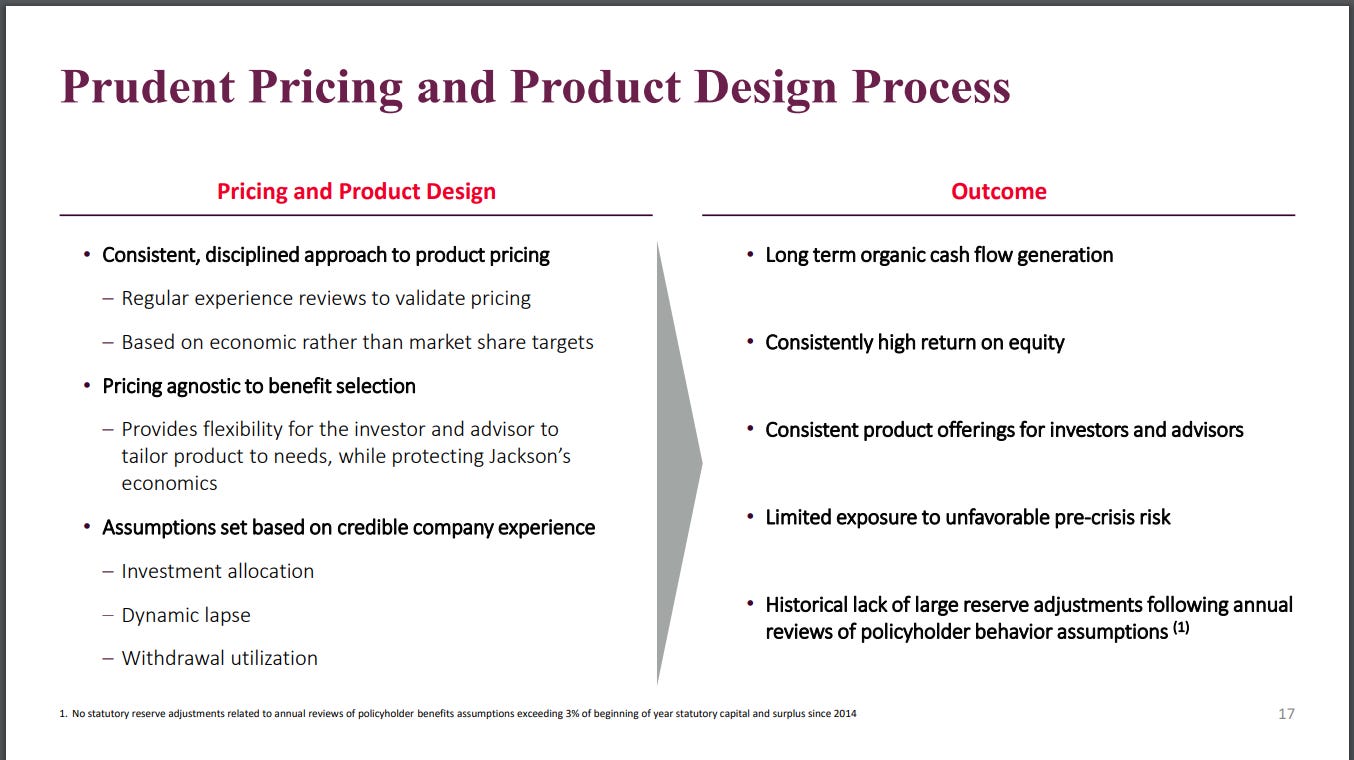

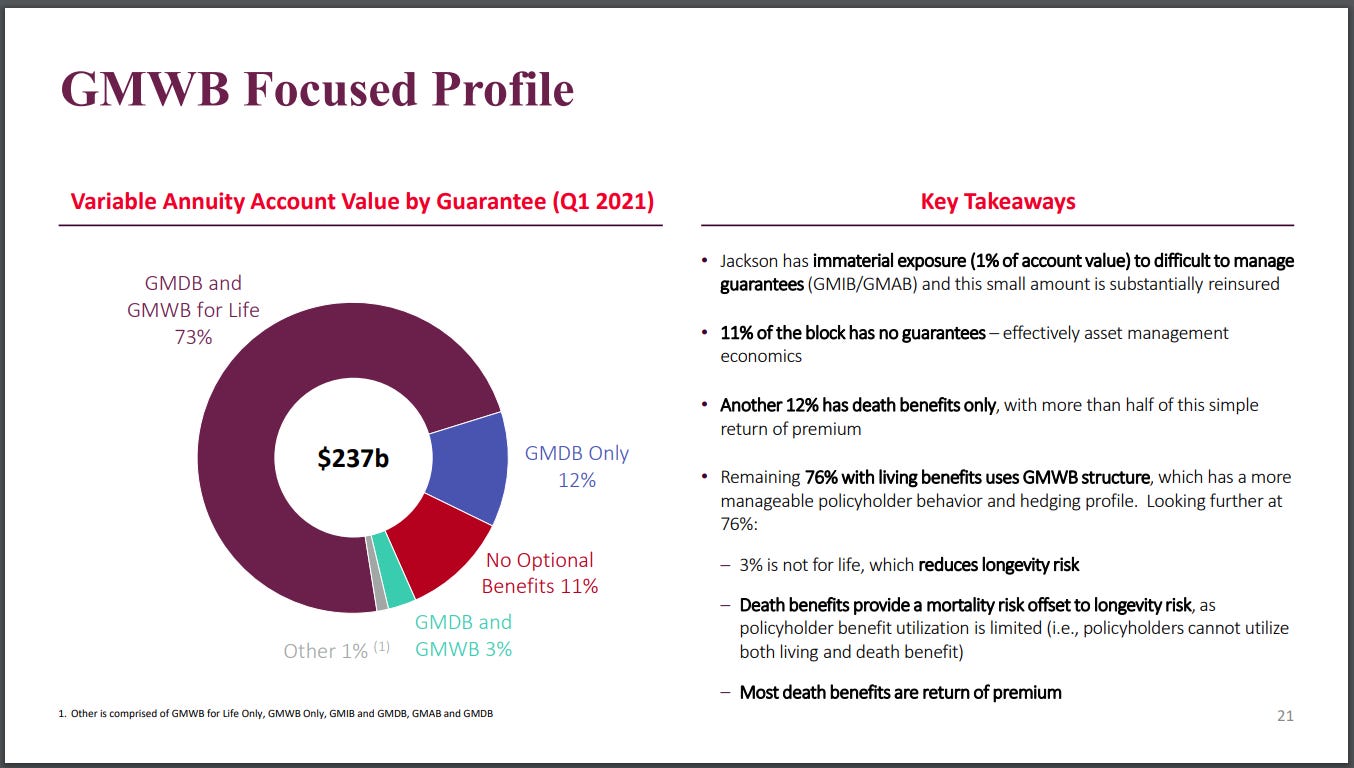

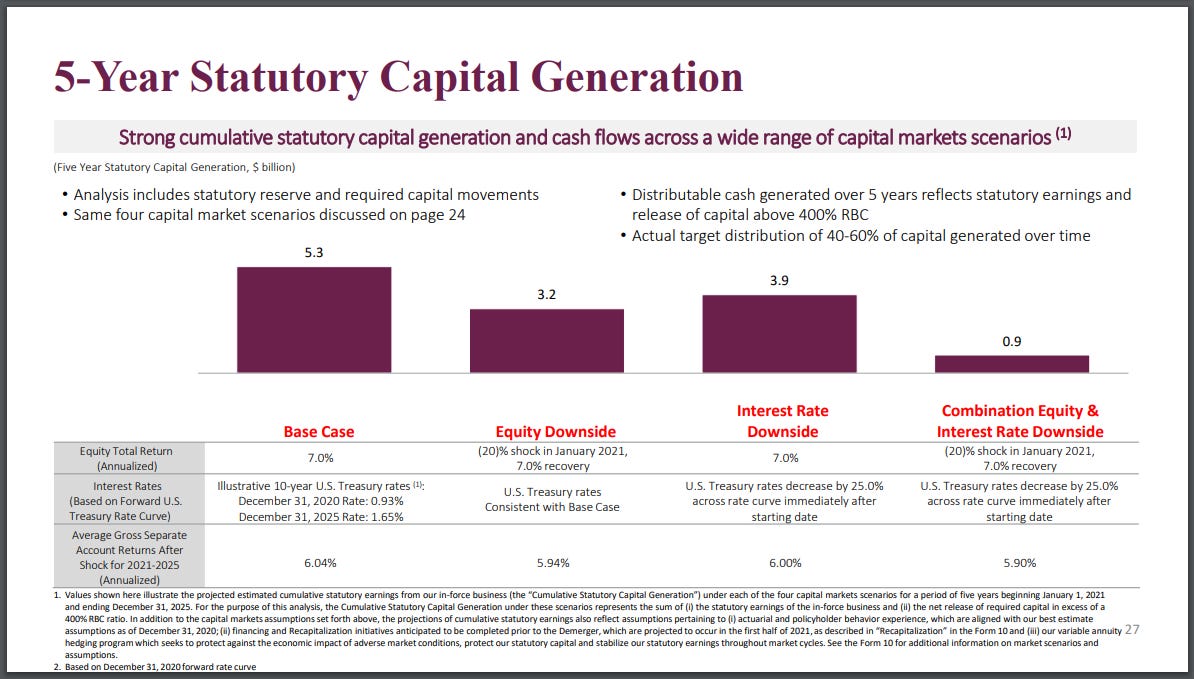

#1. Jackson Financial (JXN)

Miller Value Partners added to JXN this quarter, leading to it to become a top 10 position, and enter the 13F Dashboards.

8th largest U.S. position

4.43% of U.S. portfolio

Added 2.78% in Q2

This stock is #1 overall, due to high rankings on statistics such as:

P/E of 1.5 (3rd lowest)

P/S of 0.3 (10th lowest)

P/B of 0.4 (2nd lowest)

P/C of 1.5 (24th lowest)

P/FCF of 0.5 (1st lowest)

EPS growth of 45.7% (23rd highest)

ROE of 51.6% (9th highest)

More info in footnotes1

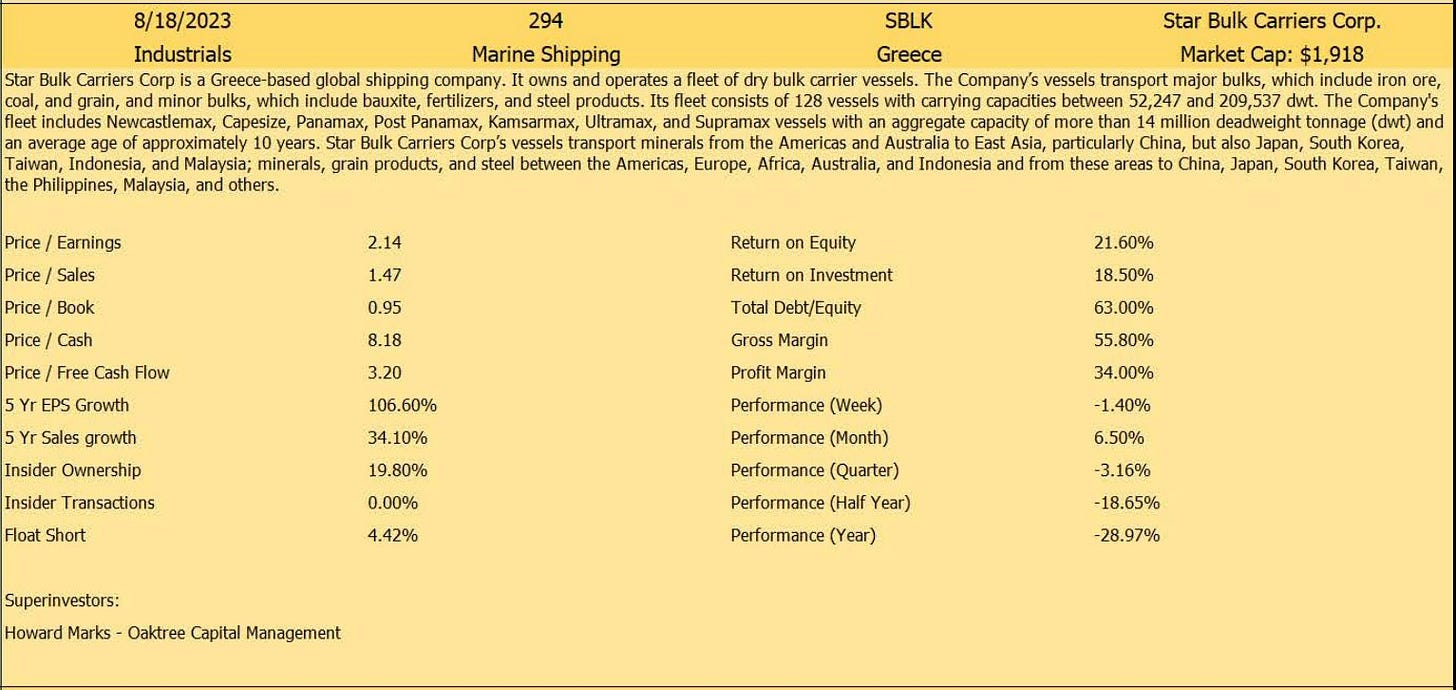

#2. Star Bulk Carriers Corp. (SBLK)

Owned by Oaktree Capital Management:

3rd largest U.S. equity position

7.26% of U.S. equity portfolio

No change in Q2

Michael Burry of Scion Asset Management added a 2.94% position in SBLK in Q2.

More info in footnotes2

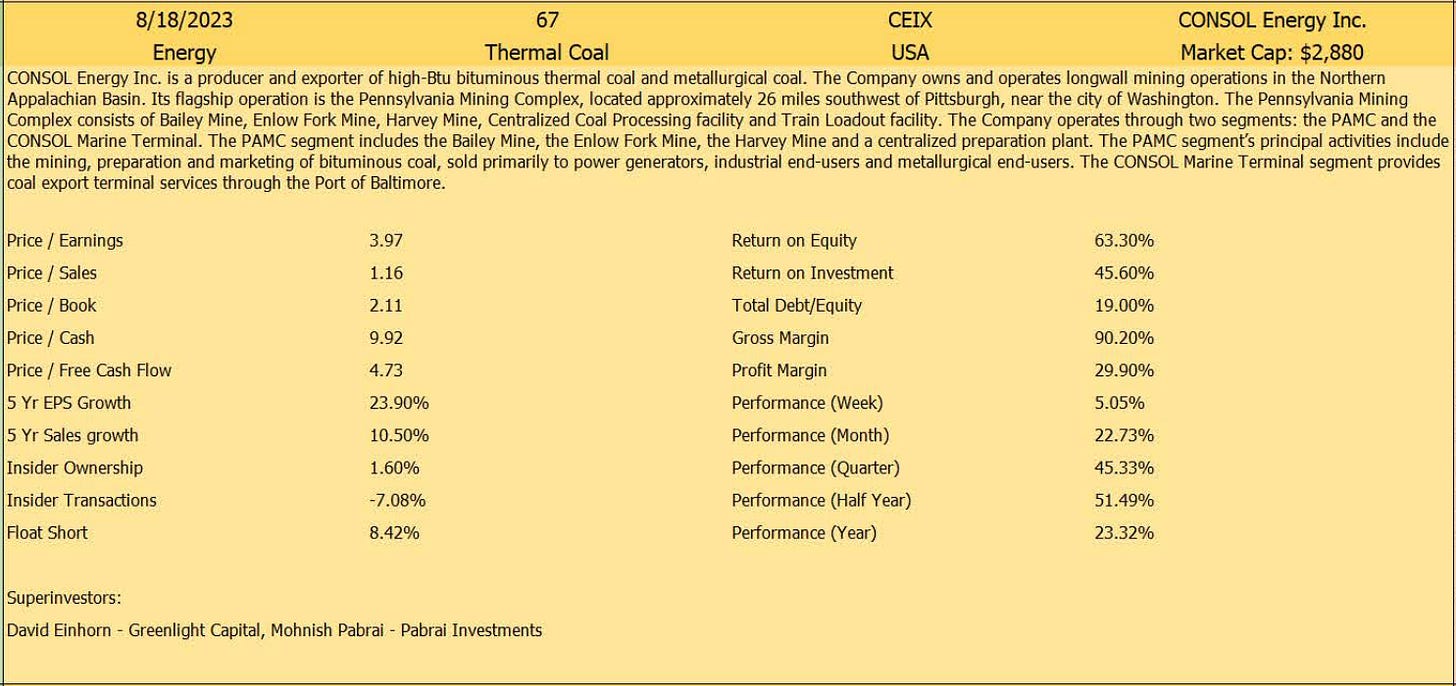

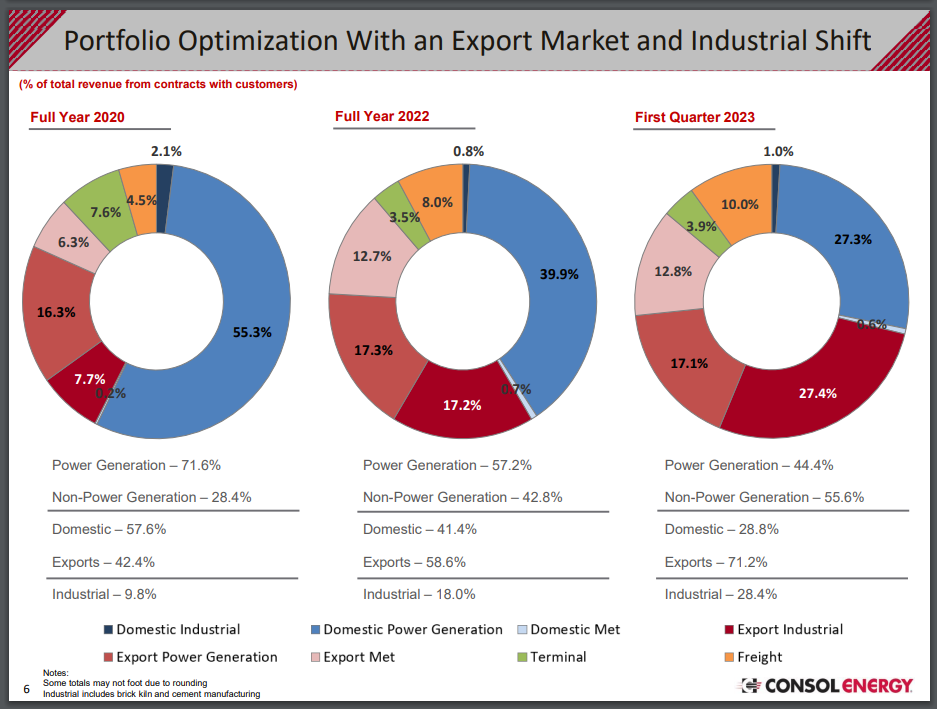

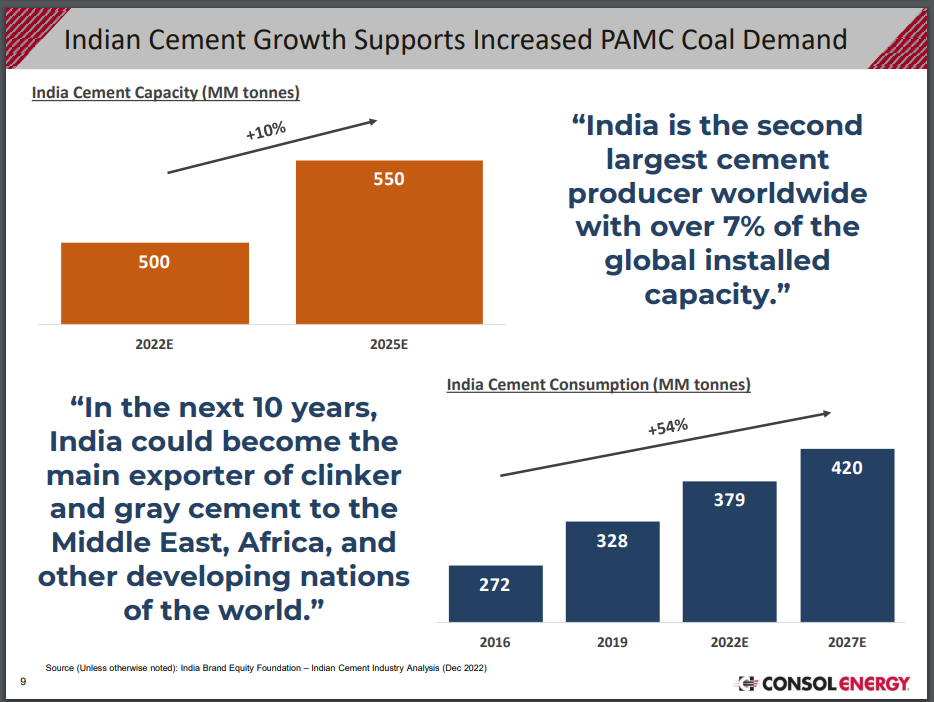

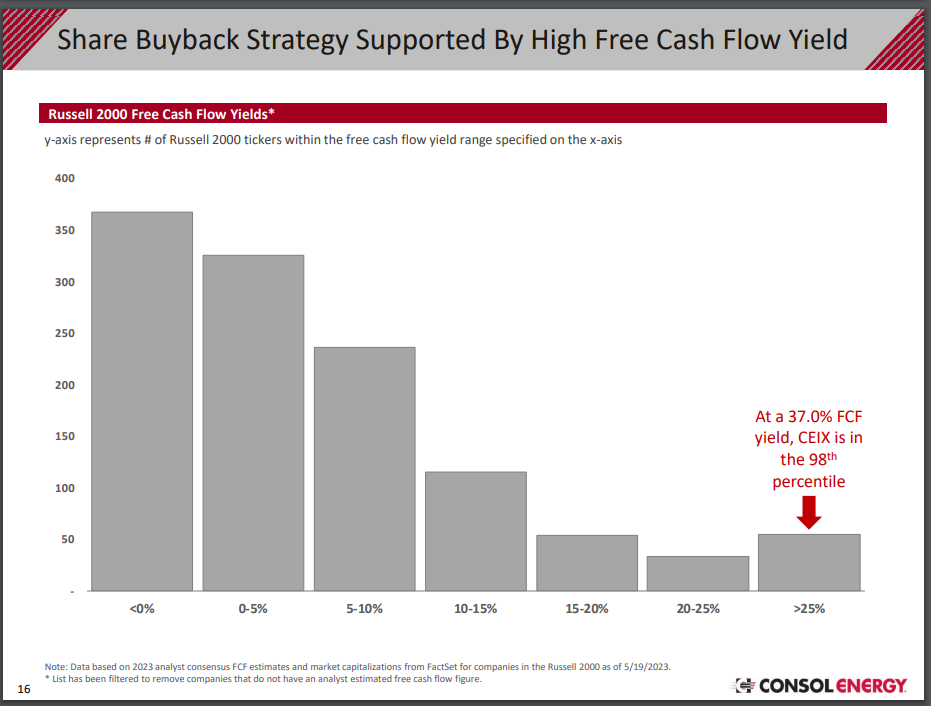

#3. CONSOL Energy Inc. (CEIX)

Owned by Mohnish Pabrai of Pabrai Investments:

2nd largest U.S. equity position

18.8% of U.S. equity portfolio

New as of Q2

Owned by David Einhorn of Greenlight Capital

2nd largest U.S. equity position

9.05% of U.S. equity portfolio

Added 4.75% in Q2

More info in footnotes3

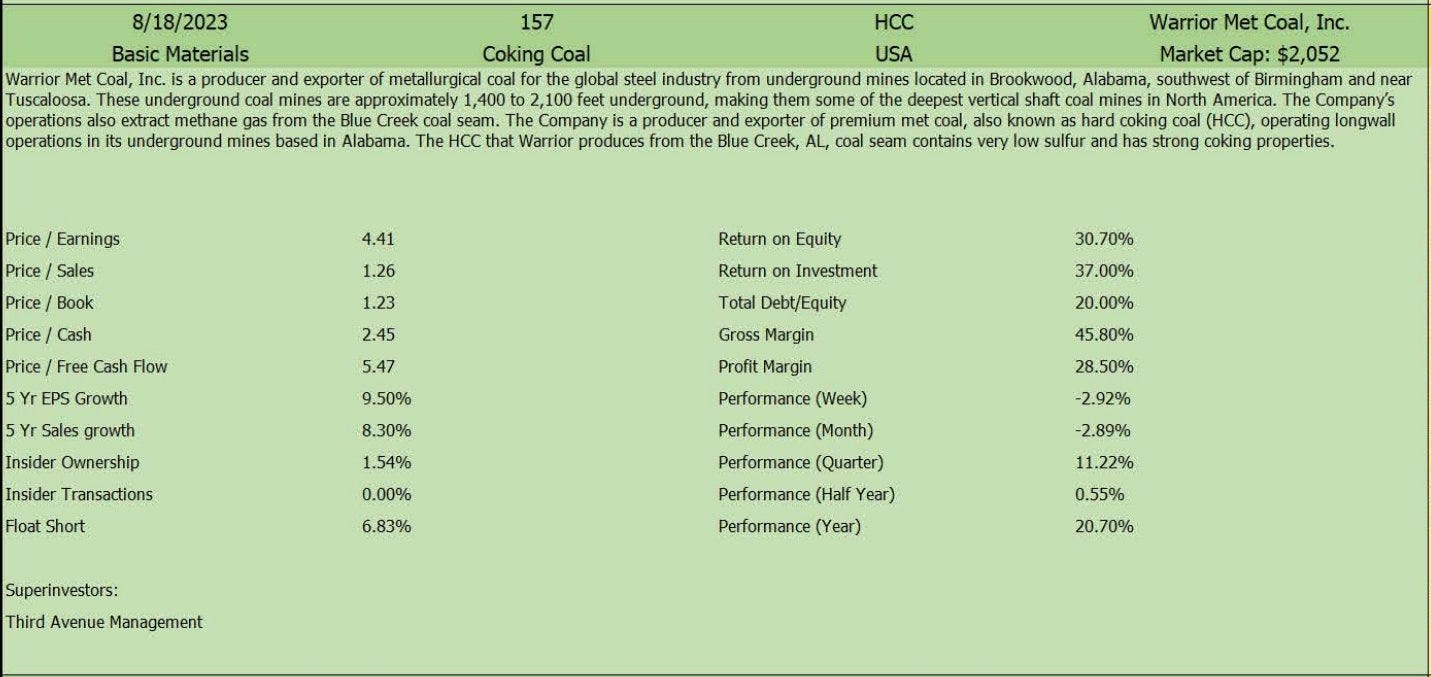

#4. Warrior Met Coal, Inc. (HCC)

Owned by Third Avenue Management:

2nd largest U.S. equity position

8.64% of U.S. equity portfolio

Added 0.12% in Q2

More info in footnotes4

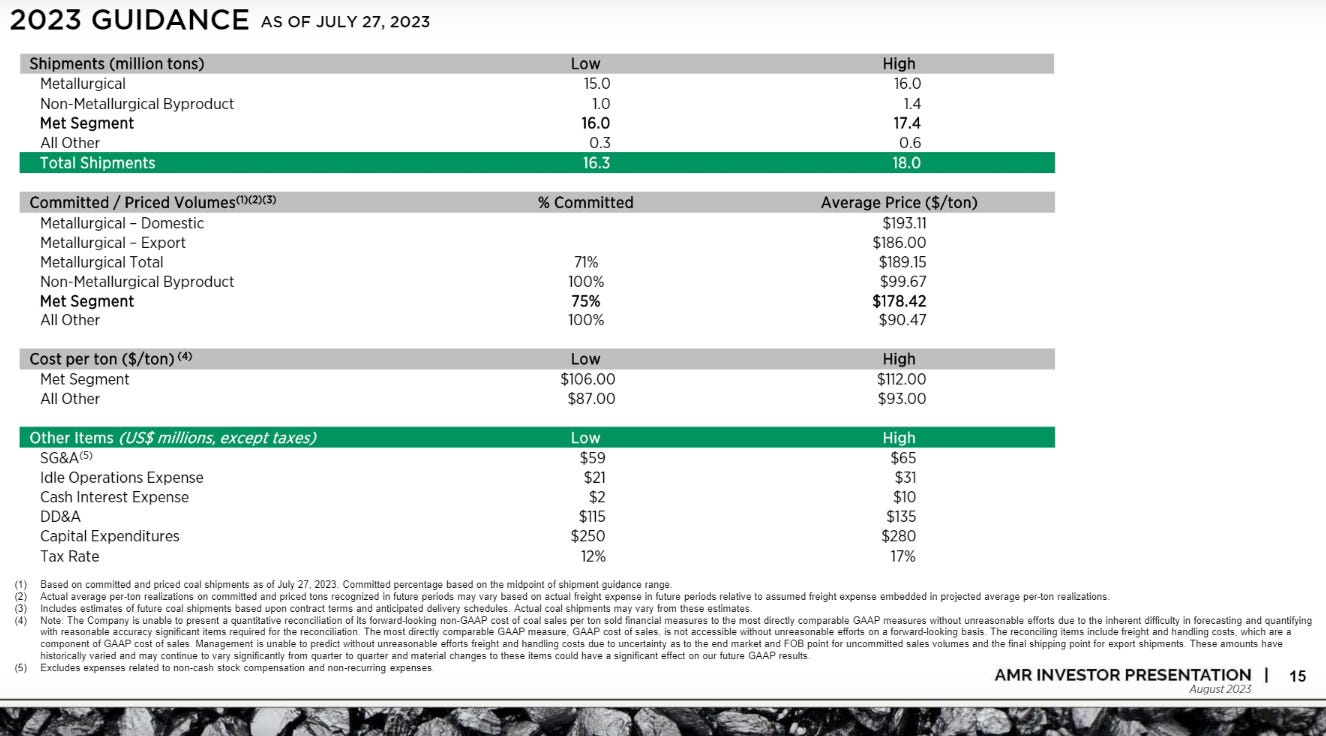

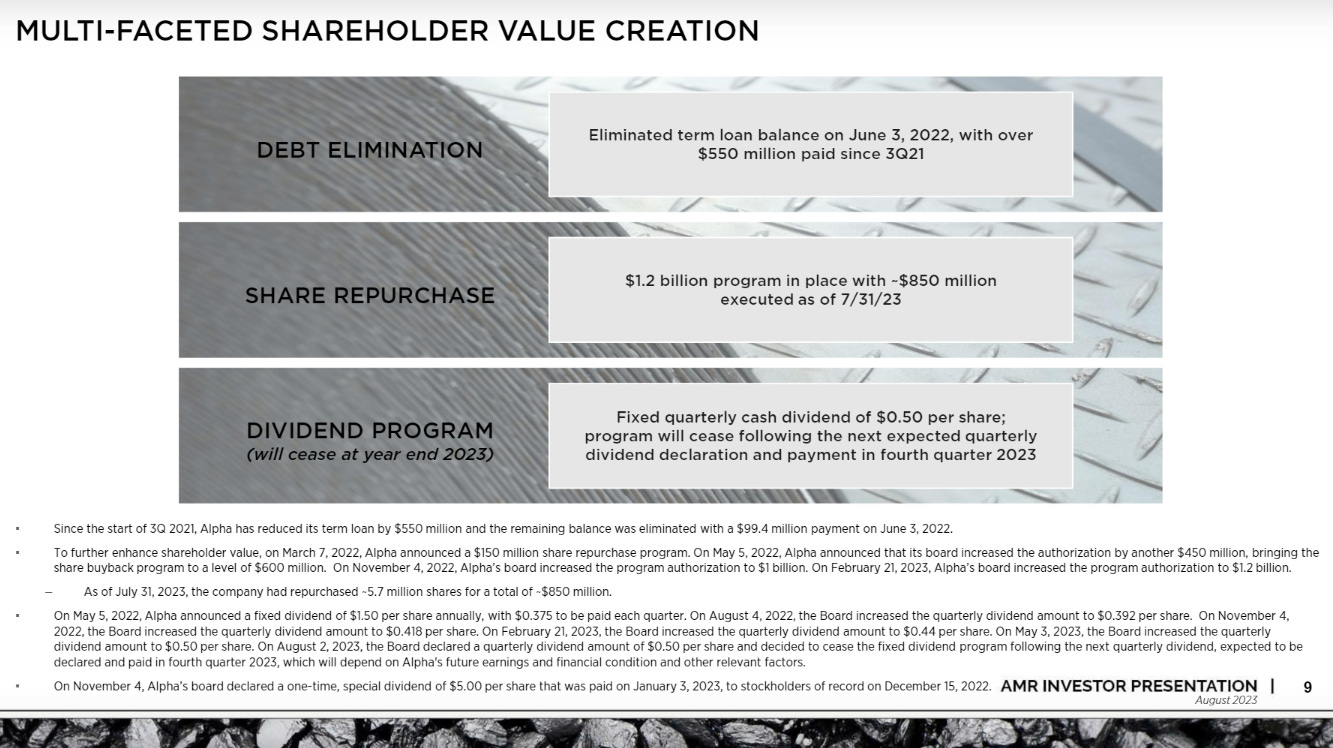

#5. Alpha Metallurgical Resources, Inc. (AMR)

Owned by Mohnish Pabrai of Pabrai Investments:

Largest U.S. equity position

81.2% of U.S. equity portfolio

New as of Q2

More info in footnotes5

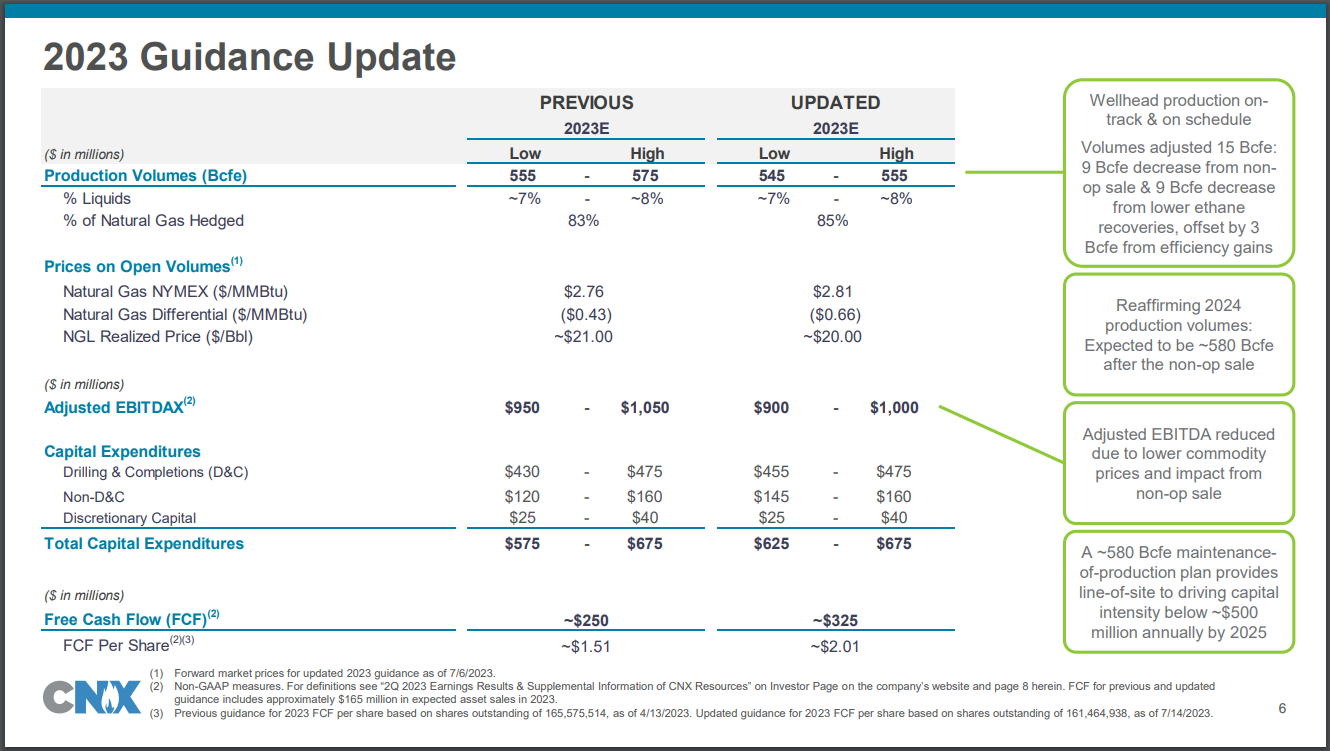

#6. CNX Resources Corporation (CNX)

Owned by Mason Hawkins of Longleaf Partners:

5th largest U.S. equity position

6.17% of U.S. equity portfolio

Added 18.71% in Q2

More info in footnotes6

#7. Vital Energy, Inc. (VTLE)

Owned by Michael Burry of Scion Asset Management:

8th largest U.S. equity position

5.07% of U.S. equity portfolio

New as of Q2

More info in footnotes7

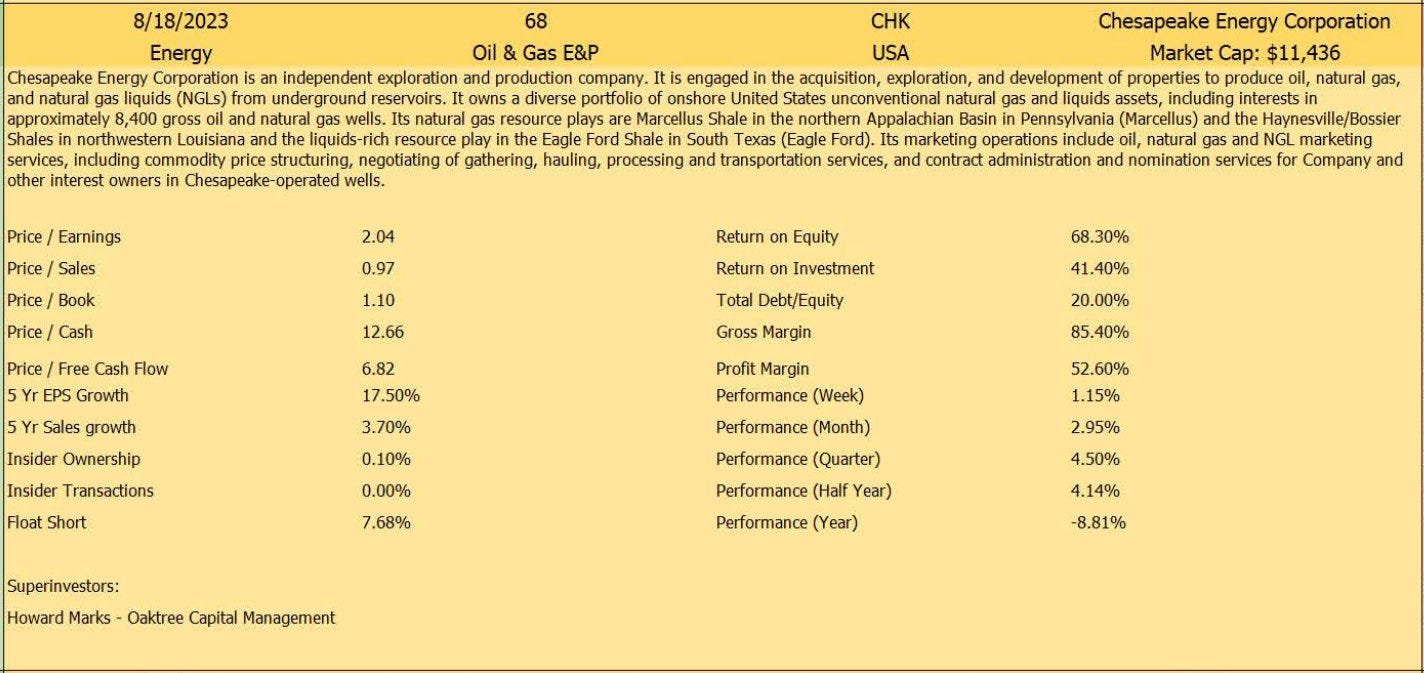

#8. Chesapeake Energy Corporation (CHK)

Owned by Oaktree Capital Management:

2nd largest U.S. equity position

9.68% of U.S. equity portfolio

Reduced by 14.33% in Q2

Also held by Miller Value Partners, Appaloosa Management, and First Eagle Investment Management, but not as a top 10 position.

More info in footnotes8

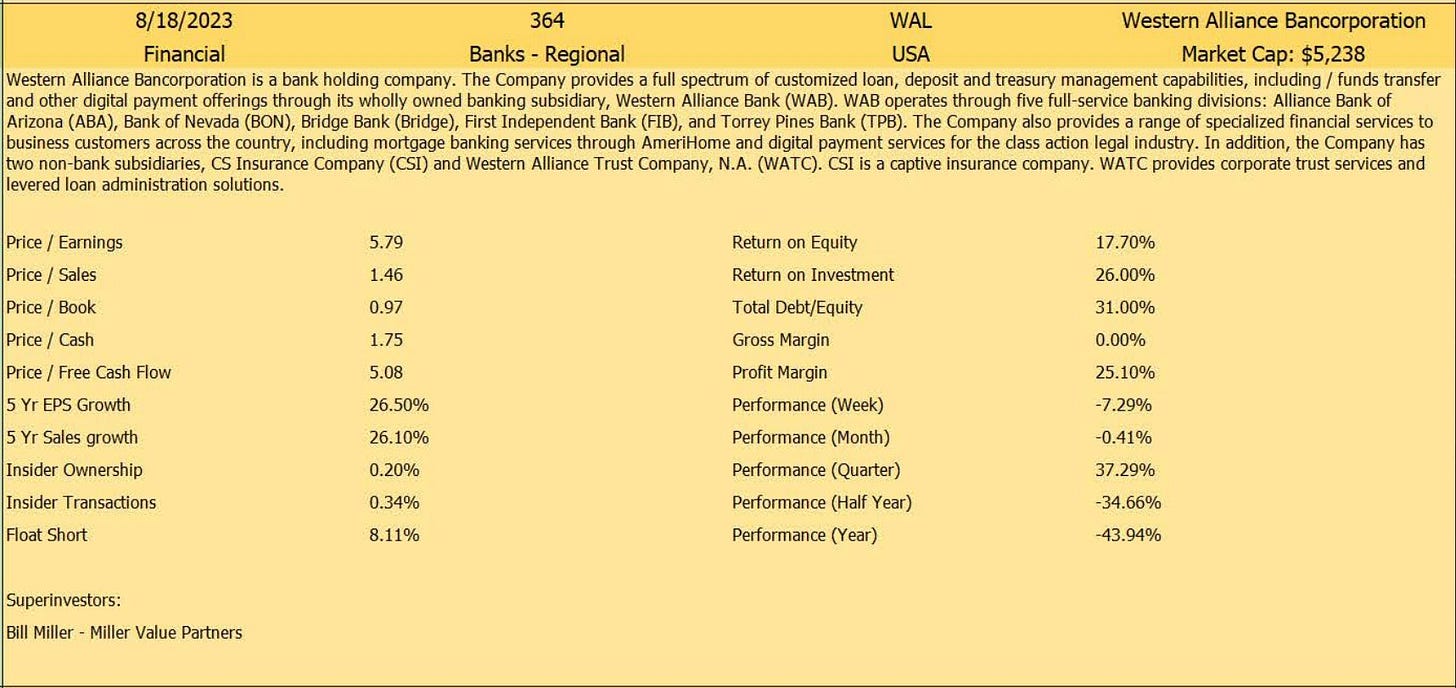

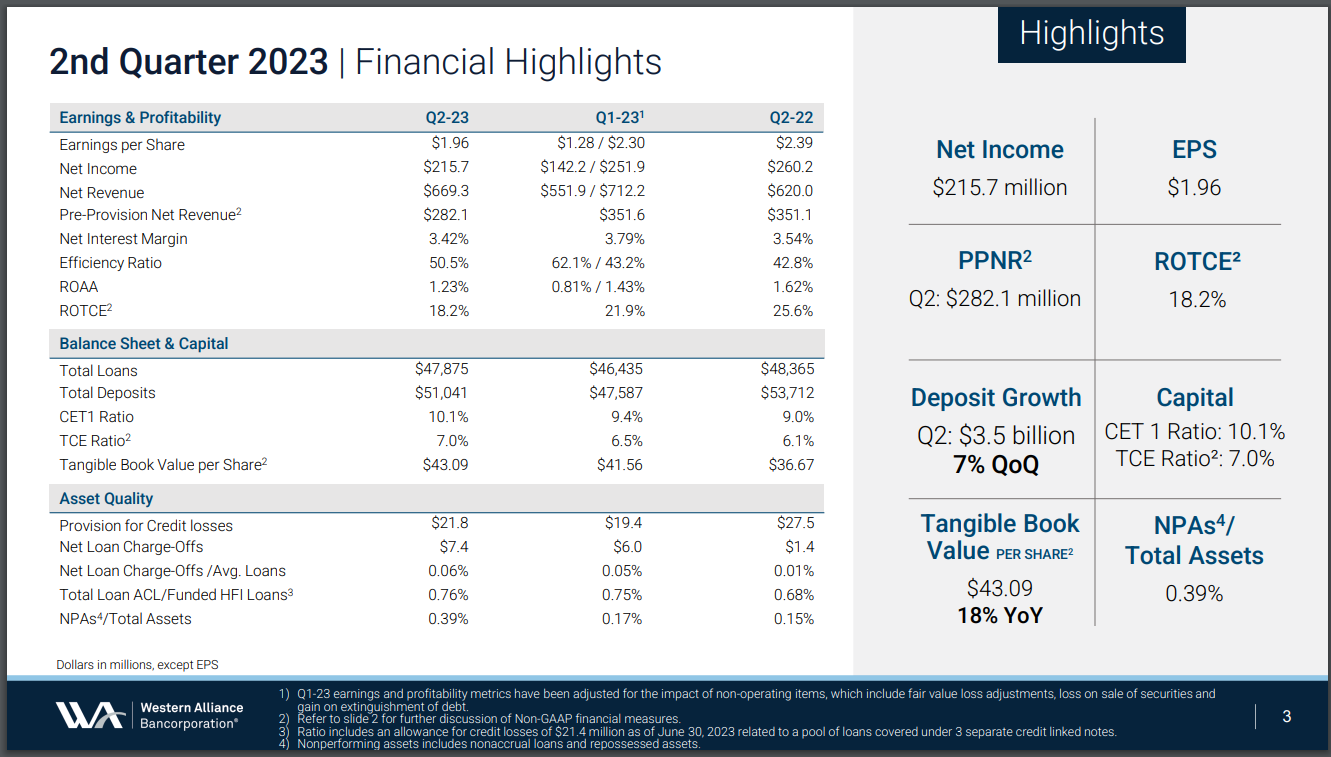

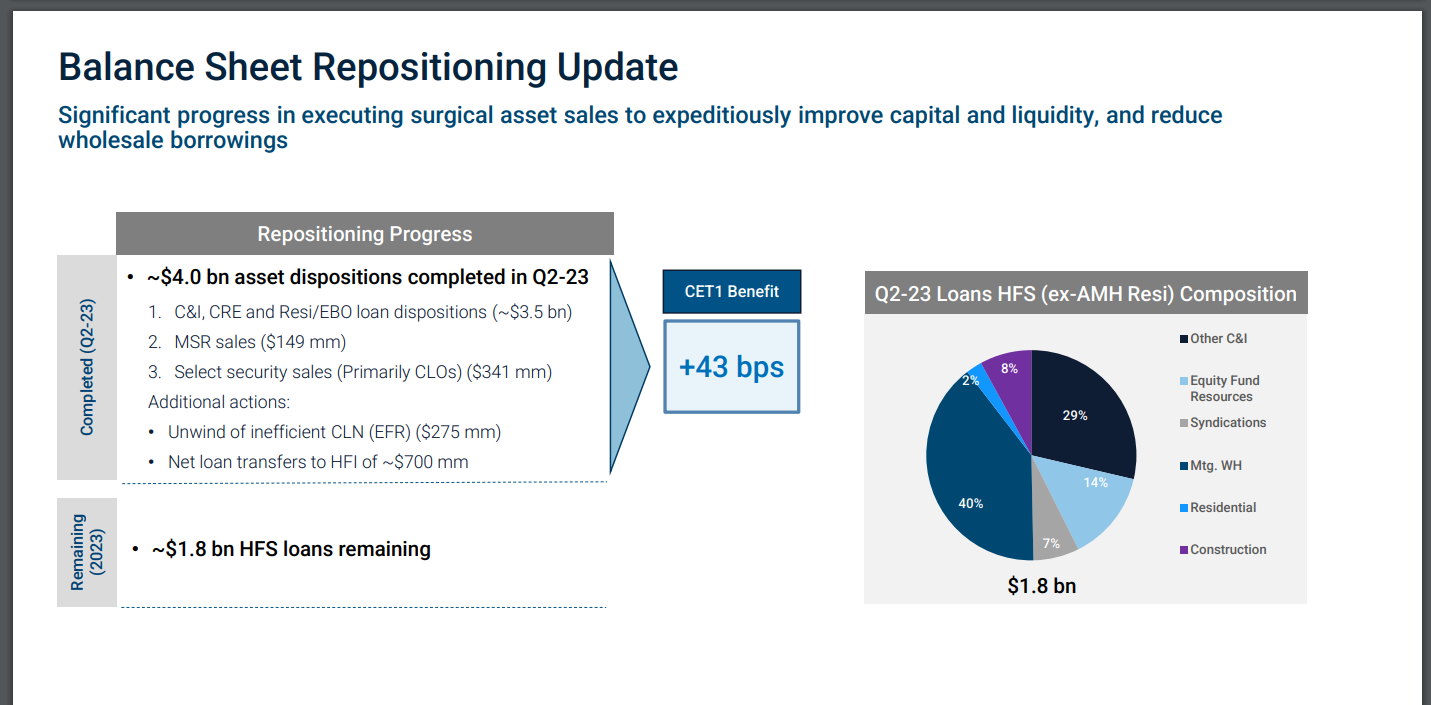

#9. Western Alliance Bancorporation (WAL)

Owned by Miller Value Partners:

7th largest U.S. equity position

4.49% of U.S. equity portfolio

Added 213.54% in Q2

More info in footnotes9

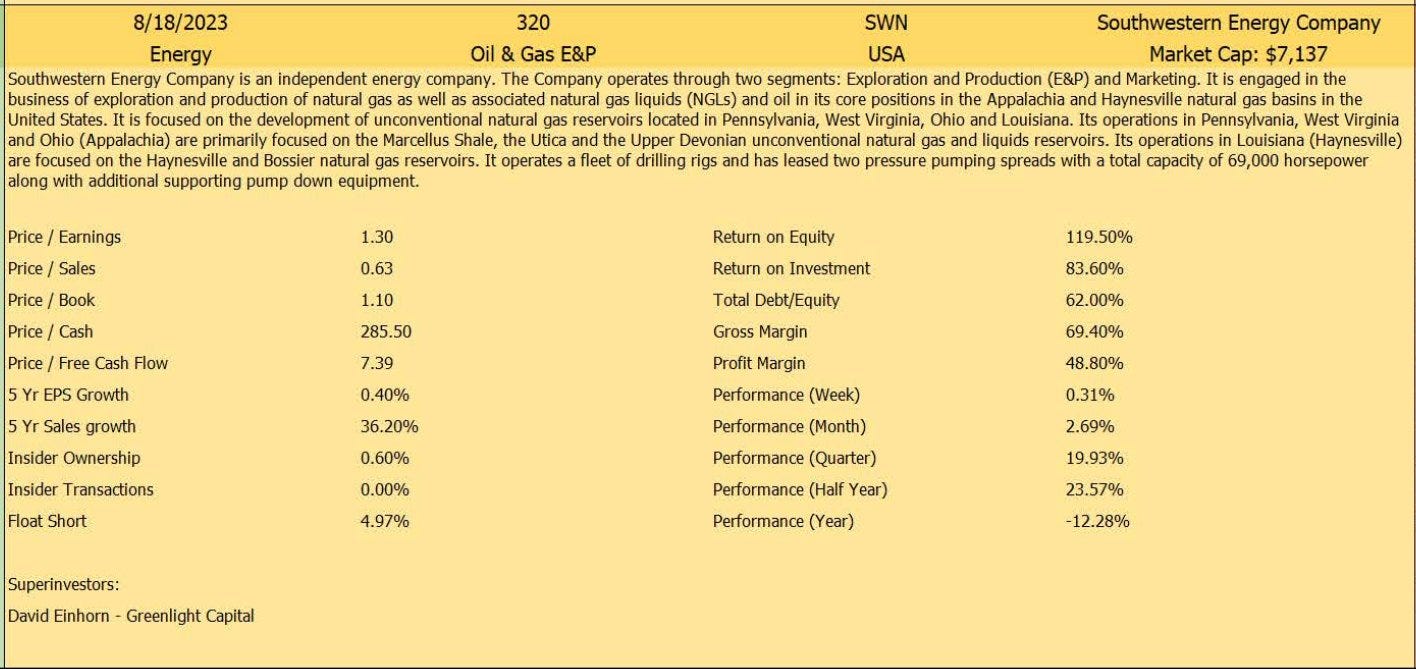

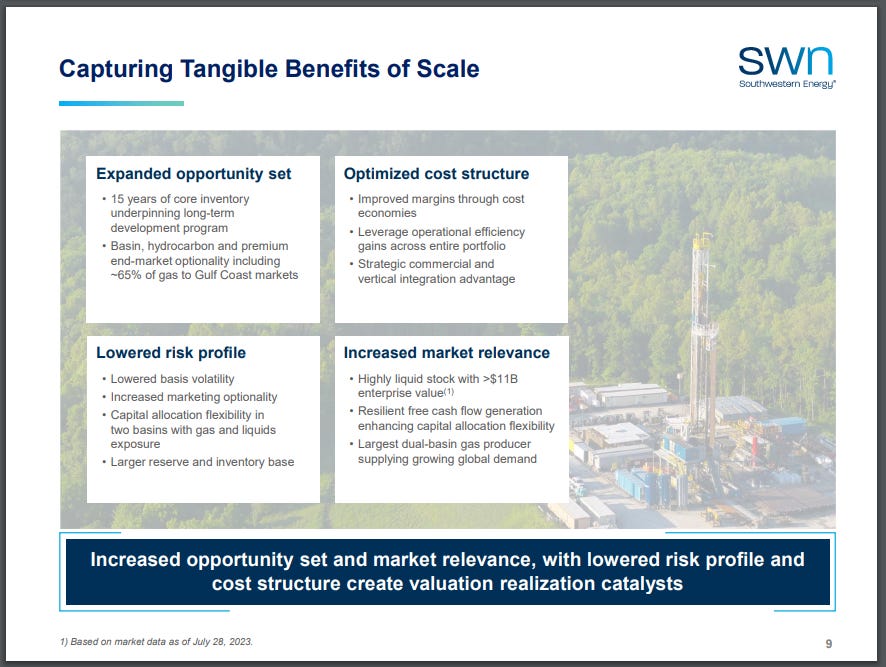

#10. Southwestern Energy Company (SWN)

Owned by David Einhorn of Greenlight Capital:

10th largest U.S. equity position

2.60% of U.S. equity portfolio

Added 3.49% in Q2

Also owned by Appaloosa Management (but not a top 10 position).

More info in footnotes10

Closing

If there is any additional information that you feel would provide value, please let me know.

Thank you,

Austin Swanson

Disclaimer: This content is not investment advice. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.